Issue.7 - Economy in Crisis Pt.1

A necessary guide for an uncertain economy.

UPDATED 03/16/23 BY THIAGO PATRIOTA

7. Introduction

Salutations. It's Thi again.

Your NCA (Non-commissioned Agent) reporting for duty.

This issue shall be the foundational study behind the Agency project and the investigation of the sea where all of our boats are currently floating.

It may be published in more than 1 part and the data in this particular issue will be updated periodically.

If you haven’t read any of the previous content, this issue will make you realize why it is important to do so.

So far we have been talking about the following:

Issue.0 - Tsunami (A threat)

Issue.2 - Boats (Our companies)

Issue.3 - Paddles (The designers)

Issue.4 - Role of a Captain (The leadership)

Issue.5 - Coffee Machines (The value of novelty ideas)

Issue.6 - People in the Sea (The consumers)

Welcome to Issue.7 - Map of the Sea (The economy)

I have been working quite hard to put all of this together for you, especially this issue.

Because it is about time we talk about the sea.

(And it is actually the ideal time considering the recent economic events.)

(The tech bubble has officially popped and I will explain why.)

*Unwears a backpack while single-leg kneeling and positioning it on the ground.

*Unzips and removes a single scroll and a massively boring pile of papers wrapped in a folder.

It is time to bring history and numbers to the table.

7.1 The Golden Age of Athens

The Birth of Western Civilization

*Positions the scroll on the table

You have to know the past to understand the present.

Carl Sagan

When it doesn’t matter what direction we look, we can’t seem to grasp new dreams, this fundamentally means that there is a problem with the ticking present moment. If clocks feel frozen in the inertia of an accumulated pile of problems caused by wrong decisions or lack of action and ideas, then we need to hit the hard reset button immediately.

Because if the present feels weak, sickened, or anesthetized we need to patch it up, we need to make it realize that its current state is only temporary and it is just going through an obstacle that will prepare it for higher immunity amidst tougher challenges. Higher achievements amidst tougher willpower.

How may we patch it up? Either with the past (history) or the future (dreams).

Today we are going with history. With the nostalgic achievements of our past. With a simple reminder of our brilliant human capacity to persevere against disasters and crises while pushing the limits of new horizons forward.

With a period in time where there was no chance to stand still because no matter what direction you looked, you felt invited to have agency and take immediate action towards your dreams.

*SLAMS THE HARD RESET BUTTON.

*Time rewinds.

You just traveled 2426 years in the past.

*Handles a Greek Hydriai (a jar of water).

Here, drink some fresh and crystalline water. Time travel messes with our hydration.

Now look around my dear reader, we are in Ancient Athens!

Standing there in the Agora, the public square of Athens is Péricles. He is surrounded by his citizens, wearing a chiton (a long tunic) and a himation (a cloak or shawl) while he gives one of his much-renowned public speeches. Nurturing his people with not only a true mastery of oratory but also the hope and inspiration that only such a leader can conceive in the heart of his followers.

*We hear rousing applause and enthusiastic support from the Athenian citizens.

Welcome back to the golden age of Athens.

A “golden age” is a time of peace, prosperity, and happiness, often when economic activities reach profound synergy and growth, and cultural activities like theater or writing reach a peak. The Greek city-state of Athens reached its Golden Age between 480 - 404 BCE (2426 years ago) under the leadership of Pericles, one of the foremost democratic leaders of Greece and the greatest political personality of the 5th century BC.

Alongside peace and trust, there flourished: politics (a fresh and crystalline democracy), law, history, architecture, economy, philosophy, sculpture, literature, representational arts such as tragedy and comedy, and sciences, all with their greatest exponents headquartered in the Athenian city.

Citizens achieved equality of speech in the Assembly: the word of a poor person had the same worth as that of a rich person. 56% of Athens' GDP was derived from manufacturing. The Gini coefficient for the citizen population was calculated as 0.708. The theatre reached its greatest height in the 5th century BC. Philosophy featured some of the most renowned Western critical thinkers of all time. Chief among these was Socrates.

It was in Athens during the time of Pericles that the foundations were laid for what would later be called “Western Civilization”. In other words, I just described above the critical moment of the birth of the western culture that we live in today. That you probably live today!

Can you feel such a splendid nostalgia flowing through your veins while resonating your whole body with goosebumps triggered by every single nerve endings in your sympathetic nervous system? Not yet?

Listen to this.

This was an era of pure splendor and a standard of living higher than any previously experienced. Never in the history of humanity has there been a city that managed to trailblaze in such brilliant growth or bring together such a large contingent of erudite people knowledgeable in all branches of human science.

Pericles' Athens earned such profound respect that it continued long after its political and military systems fell due to the defeat in the Peloponnesian War and the city's sieges by Sparta and Rome. The legacy of Athens' Golden Age exerted a strong influence on Western culture for centuries, cementing the city's status as one of the world's foremost intellectual and cultural centers.

The intellectual eminence of Athens was so formidable that even the newly-arrived conquerors succumbed to it completely. It is said that Nero, who was notorious for his brutality and for ordering the burning of Rome, held the city in high regard. Emperors Hadrian and Marcus Aurelius also spent time in Athens to engage in intellectual pursuits and enhance their own intellects. The Roman era witnessed a continuation of grand construction projects, some of which remain impressive to this day, such as the Temple of Olympian Zeus, Hadrian's Gate, and the Roman Agora.

I’m not Greek, but I’m a son of western culture, and probably so are you. The events of this era set the standard for many spheres of society we know today.

All of this just makes me feel homesick. Why? Well, when we lose connection to our origins, we destroy the foundational support we need to remember what we fight for. What the people that came before fought for.

Analyze the corporate culture of any company and you will realize that when it loses the link to its original values, its decadence gets ignited due to a lack of purpose and loss of the muscular memory behind the reasons why it was started in the first place.

History is beautifully cyclic, the economy grows, the economy falls, wars are won, wars are lost, leaders emerge, and leaders retire. There is absolutely nothing more relentless than time. Our organic nature, mine and yours are as ephemerous as the lifecycle of an orchid which blooms in youth and beauty at first but starts to decay and dry until it decomposes and turns to particles that are used by the ground to fertilize and birth the next flower to come. That is our biological life in a nutshell.

Do you know what is time-proof though?

Ideas and knowledge.

Artistic treasures.

Massive monuments.

Scientific breakthroughs.

Culture!

Thank you Pericles!

Remember, too, that if your country has the greatest name in all the world, it is because she never bent before disaster; because she has expended more life and effort in war than any other city, and has won for herself a power greater than any hitherto known, the memory of which will descend to the latest posterity.

— Thucydides, Pericles' Third Oration

*Slams the reset button again.

Sources for this chapter: Arete (Brazillian Center for Hellenic Studies), ChatGPT, Wikipedia.

7.2 An X-Ray in the 2023 US Economy

Let’s analyze the indicators together, shall we?

Now that we know what an ideal scenario looks and feels like, we can start analyzing the ticking moment of our present.

*Positions a pile of documents on the table

Diagnosing an economy with the condition of a recession should be a job only for true economists, governments, and the wolves of wall street, so my goal here will be to point out symptoms so that we can start understanding the landscape (autonomously) and think about how to take action in a potential context of an economical crisis.

A common rule of thumb for identifying recessions is experiencing two consecutive quarters of negative gross domestic product (GDP) growth.

Federal Reserve Bank of St Louis

A recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.

National Bureau of Economic Research (NBER)

I pinpointed a total of 10 categories of economical indicators and cross-referenced them below with the most recent data I could find along with their sources. Unit conversions, calculations, and averages are provided by Chat GPT 4.0

How to read the following data:

🟢: Positive | 🔴: Negative | 🔵: Neutral

These dots indicate if the change in value is a positive, negative, or neutral indicator of the economy amidst the context of the analyzed data.

🟣: Neutral (+) | 🟤: Neutral (-)

These dots indicate if the value has grown or contracted but don’t necessarily indicate negative or positive statuses due to the nature of the analyzed data.

Reading should be done on a Z-Pattern Layout

US GDP Growth Rate: Percentage Change (Source)

A decline in GDP for two consecutive quarters is a common definition of a recession. GDP measures the total value of goods and services produced in a country over a specific period.

🟢 Q1 21: +2.8% | 🟢 Q2 21: +3.3%

🟢 Q3 21: +2.2% | 🟢 Q4 21: +3.4%

🟢 Q1 22: +1.6% | 🟢 Q2 22: +2.1%

🟢 Q3 22: +1.9% | 🟢 Q4 22: +1.6%

Sum: 🟢 +18.9% / Average: 🟢 +2.7%%

Growth rates in 2022 are somewhat slower compared to 2021, which could suggest a decelerating economy.

US Unemployment Rate: Percentage Change (Source)

A rising unemployment rate indicates that businesses are cutting back on their workforce, which can be a sign of economic contraction.

🔵 Apr 22: +0.0% | 🔵 May 22: 0.0%

🔵 Jun 22: 0.0% | 🔴 Jul 22: -2.7%

🟢 Aug 22: +5.7% | 🔴 Sep 22: -5.4%

🟢Oct 22: +5.7% | 🔴 Nov 22: -2.7%

🔴 Dec 22: -2.7% | 🔴Jan 23: -2.9%

🟢 Feb 23: +5.9%

Sum: 🔴 -1.2%

Average: 🔴 -0.1%

Suggesting that there is no significant trend of increasing or decreasing unemployment rates during this period. In general, the unemployment rate appears to be relatively stable, with small fluctuations

Inflation Rate: Percentage Change (Source 1 / Source 2)

Inflation rates can provide insight into the overall health of an economy. During a recession, inflation rates may decline as demand for goods and services decreases.

🟤 Apr 22: -0.2% | 🟣 May 22: +0.3%

🟣 Jun 22: +0.5% | 🟤 Jul 22: -0.6%

🟤 Aug 22: -0.2% | 🟤 Sep 22: -0.1%

🟤 Oct 22: -0.5% | 🟤 Nov 22: -0.6%

🟤 Dec 22: -0.6% | 🟤 Jan 23: -0.1%

🟤 Feb 22: -0.4%

Sum: 🟤 -2.5%

Average: 🟤 -0.22%

Indicates a slight decline in the overall price level. This may suggest deflationary pressures, which, if persistent, can lead to reduced consumer spending, lower business investment, and economic stagnation.

Industrial Production: Percentage Change (Source)

A decrease in industrial production can signal a weakening economy, as businesses scale back production in response to reduced demand.

🟢 Apr 22: +0.6% | 🔴 May 22: -0.1%

🔴 Jun 22: -0.2% | 🟢 Jul 22: +0.5%

🔴 Aug 22: -0.1% | 🟢 Sep 22: +0.2%

🔵Oct 22: 0.0% | 🔴 Nov 22: -0.6%

🔴 Dec 22: -1.0% | 🔵 Jan 23: 0.0%

Sum: 🔴 -0.7%

Average: 🔴 -0.07%

Despite the mixed results, it is concerning that there were several months of negative growth, particularly the larger decline in December 2022. This indicates that the economy may be experiencing some challenges

Stock Market Performance (S&P 500): Percentage Change (Source)

While stock markets can be volatile and are not always directly correlated with economic performance, prolonged declines in stock market indices can reflect investors' concerns about the economy.

🔵 Apr 22: 0.0% | 🔴 May 22: -8.0%

🔴 Jun 22: -3.5% | 🟢 Jul 22: +0.3%

🟢 Aug 22: +6.3% | 🔴 Sep 22: -7.4%

🔴Oct 22: -3.2% | 🟢 Nov 22: +5.1%

🔴 Dec 22: -0.1% | 🟢 Jan 23: +1.2%

🟢 Feb 23: +3.0%

Sum: 🔴 -6.3%

Average: 🔴 -0.57%

Suggests a slight overall decline. However, the data shows considerable volatility, with significant fluctuations between gains and losses. This inconsistency could reflect investor uncertainty and changing market conditions during the period.

Consumer Sentiment/Confidence (University of Michigan): Percentage Change (Source)

A decline in consumer confidence suggests that people are less willing to spend money on goods and services, which can contribute to a slowdown in economic growth.

🟢 Apr 22: +9.7% | 🔴 May 22: -10.4%

🔴 Jun 22: -14.4% | 🟢 Jul 22: +3.0%

🟢 Aug 22: +13.0% | 🟢 Sep 22: +0.7%

🟢Oct 22: +2.2% | 🔴 Nov 22: -5.1%

🟢 Dec 22: +5.1% | 🟢 Jan 23: +8.7%

Sum: 🟢 +12.5%

Average: 🟢 +1.25%,

This indicates an overall increase. This could suggest varying consumer confidence levels in the economy, influenced by changing economic conditions and external factors.

Business Confidence Index (BCI): Percentage Change (Source 1 / Source 2)

Lower business confidence can lead to reduced investment in equipment, infrastructure, and expansion, further contributing to a slowing economy.

🔴 Apr 22: -0.2% | 🔴 May 22: -0.2%

🔴 Jun 22: -0.3% | 🔴 Jul 22: -0.2%

🔴 Aug 22: -0.1% | 🔴 Sep 22: -0.2%

🔴Oct 22: -0.2% | 🔴 Nov 22: -0.2%

🔴 Dec 22: -0.2% | 🔴 Jan 23: -0.1%

🔴 Feb 23: -0.1%

Sum: 🔴 -2%

Average: 🔴 -0.20%.

This may indicate businesses are less optimistic about future economic prospects, which could lead to reduced investments in equipment, infrastructure, and expansion, potentially slowing the economy.

United States Housing Starts: Percentage Change (Source)

A slowdown in housing construction can be indicative of economic weakness.

🟢 Apr 22: +5.2% | 🔴 May 22: -13.4%

🟢 Jun 22: +0.8% | 🔴 Jul 22: -12.5%

🟢 Aug 22: +9.5% | 🔴 Sep 22: -2.8%

🔴Oct 22: -2.6% | 🔴 Nov 22: -0.5%

🔴 Dec 22: -5.0% | 🔴 Jan 23: -2.0%

🟢 Feb 23: +9.7%

Sum: 🔴 -13.6%

Average: 🔴 -1.23%.

This indicates an unstable housing market during this time. This inconsistency in housing starts can suggest uncertainty in the sector, which may impact economic growth and signal potential weakness in the overall economy.

Interest Rates (Federal Funds Effective Rate): Percentage Change (Source)

Central banks, such as the Federal Reserve in the United States, may adjust interest rates to manage economic growth and inflation. Rising federal interest rates can indicate efforts to control inflation or strong economic growth (risking an inversion in the yield curve), while falling federal interest rates may signal attempts to stimulate a sluggish economy or combat a recession.

🟣 Apr 22: +0.1% | 🟣 May 22: +0.4%

🟣 Jun 22: +0.4% | 🟣 Jul 22: +0.4%

🟣 Aug 22: +0.6% | 🟣 Sep 22: +0.2%

🟣Oct 22: +0.5% | 🟣 Nov 22: +0.7%

🟣 Dec 22: +0.3% | 🟣 Jan 23: +0.2%

🟣 Feb 23: +0.2%

Sum: 🟣 +4.0%

Average: 🟣 +0.4%

This suggests the central bank may be managing inflation or views the economy as growing steadily. However, a thorough analysis requires considering multiple economic indicators to gain a comprehensive understanding of the economy's health.

Retail Sales: Retail Trade and Food Services: Percentage Change (Source)

A decline in retail sales indicates that consumers are spending less, which can be a sign of economic contraction.

🟢 Apr 22: +0.7% | 🟢 May 22: +0.3%

🟢 Jun 22: +1.0% | 🔴 Jul 22: -0.4%

🟢 Aug 22: +0.6% | 🔴 Sep 22: -0.1%

🟢 Oct 22: +1.0% | 🔴 Nov 22: -1.0%

🔴 Dec 22: -0.8% | 🟢 Jan 23: +3.2%

Sum: 🟢 +4.5%

Average: 🟢 +0.45%

This figure suggests that, on average, there has been a modest increase in retail sales during the given period. However, the fluctuations in the data indicate some volatility, so it's essential to consider other economic indicators to gain a comprehensive understanding of the economy's health.

7.3 A Diagnosis for the 2023 US Economy

Enough colored dots and boring percentages.

beep.

beep.

beep.

The heart of our patient seems to work fine and the heart rate monitor beeps at a perfect and rhythmic frequency.

The numbers from updated datasets and reports fluctuate between positive and negative values indicating a swift balance in a complex system that seems to function as it should.

The only 3 indicators that seem to alert some anomalies are the following: Stock Market Performance, Business Confidence Index, and United States Housing Starts.

Two of these regard the readers of Agency as they are directly related to business and entrepreneurship: Business Confidence and Stock Market Performance.

This indicates that throughout the previous 11 months, business owners and decision-makers don’t seem to be hopeful for the future of the economy and this impacts how they act on behalf of their companies. Regardless of all the healthy indicators above, for some reason, the economy doesn’t feel safe for the innovators of the free market. Expansion, investment in equipment, infrastructure, and talents lose priority when the main goal is to survive the next batch of challenges.

This context is vastly different from the golden age of Athens, where the “emporoi" or "merchants.” didn’t seem to lack the confidence to take risks or expand their ventures. The collective attitude of collaboration among the people in Athens made it a safe and comfortable landscape for growth. Trust was granted freely and this would be the opposite of low confidence levels.

A symptom is a manifestation or indication of a medical condition or disease and our patient doesn’t indicate any tangible symptom for a diagnosis.

As the patient is discharged, an acute pain is felt in the organism and we might just have found the opportunity to understand why things don’t feel right.

7.4 The Technology Industry

A Bubble seems to have burst.

Last Friday (March 10th) an anomaly manifested in the system and it caught everyone with guards down. Silicon Valley Bank was shut down by regulators in biggest bank failure since global financial crisis in 2008.

SVB represents one of the financial backbones of the US technology industry which encompasses many of the technological solutions we use nowadays. But it’s not just the tech industry that banked with SVB.

The streaming devices maker Roku says it has about $487 million, or 26% of its cash and cash equivalents, held in deposits with SVB.

The online gaming firm Roblox says about 5% of its $3 billion cash and securities balance, or about $150 million, as of Feb. 28 were held with SVB.

The digital media firm Buzzfeed said it had about $56 million in cash and cash equivalents at the end of 2022, majority of which was held at SVB.

U.S. cryptocurrency firm Circle says $3.3 billion of its $40 billion of USD Coin reserves are at SVB.

The breaking of SVB was kickstarted by a bank run from the actual clients of the company. The massive amount of customer withdrawals that led to the collapse of Silicon Valley Bank had all the hallmarks of an old-fashioned bank run, but with a new twist befitting the primary industry the bank served: much of it unfolded online.

All of this is extremely similar to what happened back in 2008 when the housing bubble burst and started a bank run as well. Back then, the economic indicators seemed healthy just like the ones we studied above, so we are in a context where no one can truly know what is about to unfold.

Financial specialists were very fast in taking sides in regard to what should be done in order to mitigate the problems (the ripple effect), some pointed out that A) the bank and executives had to take the fall for poor management decisions, and others said that B) it was the government’s role to intervene and provide liquidity for the depositors so that they could access their money as soon as possible.

The B) approach happened, precisely like what happened back in 2008 when the government intervened. The Biden administration announced Sunday night (March 12th) that all depositors at the failed Silicon Valley Bank would have access to all their money on Monday morning, approving an extraordinary intervention aimed at averting a crisis in the financial system.

The rescue may be a pragmatic move to protect blameless depositors, says FT Innovation Editor John Thornhill, but some will take exception to help an industry that often rails against regulation and tycoons who appear to favor the privatization of profits and the socialization of losses.

Financial Times

US capitalism is ‘breaking down before our eyes’, says Ken Griffin. Citadel founder argues that refusing to bail out SVB depositors in full would be ‘great lesson in moral hazard’

Financial Times

What is to unfold next is not yet known, but it will be crucial to stay informed as this event can magnify and impact the global economy.

Keep an eye out for the data shown on this issue as it will be updated periodically.

7.5 Coming Next (Economy in Crisis Pt.2)

What to expect?

As mentioned in the introduction of this issue, the subject of the economy will be approached in more than one part. For this one, I mapped out the necessary information for us to understand the scenario. The sea.

For the next, I intend to point out what industries and markets might benefit and grow in a scenario of uncertainty.

Over and out!

7.6 Pandora’s Box

A Fresh Digest on my latest discoveries and some other things.

7.6.1 In the Lenses of Thi

7.6.2 History in Cinema

The 2008 economic crisis has been depicted in the movie “The Big Short” directed by Adam Mckay and starring a stellar group of actors. Steve Carell, Ryan Gosling, Cristopher Bale, and Brad Pitt. This movie is a cinematographic experience as much as it is a class about the financial market with some mysteries about what may have happened back then. It is highly recommended to watch it at this moment.

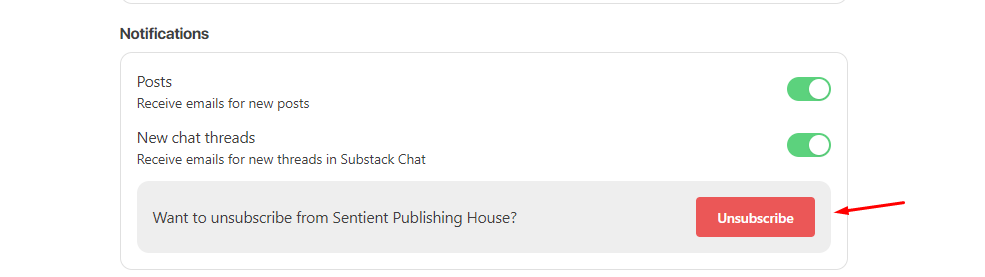

Unsubscribe

I noticed that the user experience of unsubscribing can be a little confusing here on Substack. I do want to share my ideas, but I don’t really want to be a bother if you don’t like the content. Below are some instructions on how to unsubscribe from the newsletter.

Website

About the Author

Thiago Patriota

Made in 1996. Born & Raised Brazillian. Bachelor’s Degree in Advertising and Communication. Adept to autodidactism. Curious Soul. Published Author. Founder of Sentient.

That’s me in a nutshell but you can learn more about Agency and myself on the About page!

The Athens reminder was an encouraging Hallmark that I shall carry in my heart. To have faith in humanity is fundamental to our sanity.

This was a brilliant piece, almost like reading a screenplay or a prose poem. I loved how you bring us back to the glories of Pericles' Athens to describe what a flourishing prosperous society looked like then. The imagery of Athena was a great choice (she's a personal favorite of mine), and then how you brought us back to the disturbing financial present with an irrefutable citation of stats. IDK how far you got into the SVB situation, but there are more layers of that onion to peel back. Bravo, Thi! And thank you for creating this.